how to lower property taxes in california

As a result one of the most effective strategies to lower your total tax burden is to lower the assessed value of your homein other words by. For example theres a 7000.

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

ASSESSMENT INFORMATION Christina Wynn Assessor 3636 AMERICAN RIVER DRIVE SUITE 200 SACRAMENTO CA 95864-5952 Office Hours 8 am.

. If a homeowner feels that there was an incorrect valuation of their home they may be able to reduce their California property. This means if a parent bought a property in the 1970s and has a tax basis that is. The following are 10 ways to lower taxes that are frequently overlooked by even the most sophisticated California commercial property owner.

Here are a few steps you can take to cut your property taxes. The County Auditor-Controller is responsible for calculating the debt service tax rates for repayment of local bonds applying rates to the assessed value of property on the local tax roll. Property taxes can be significantly higher depending on the kind of property you own.

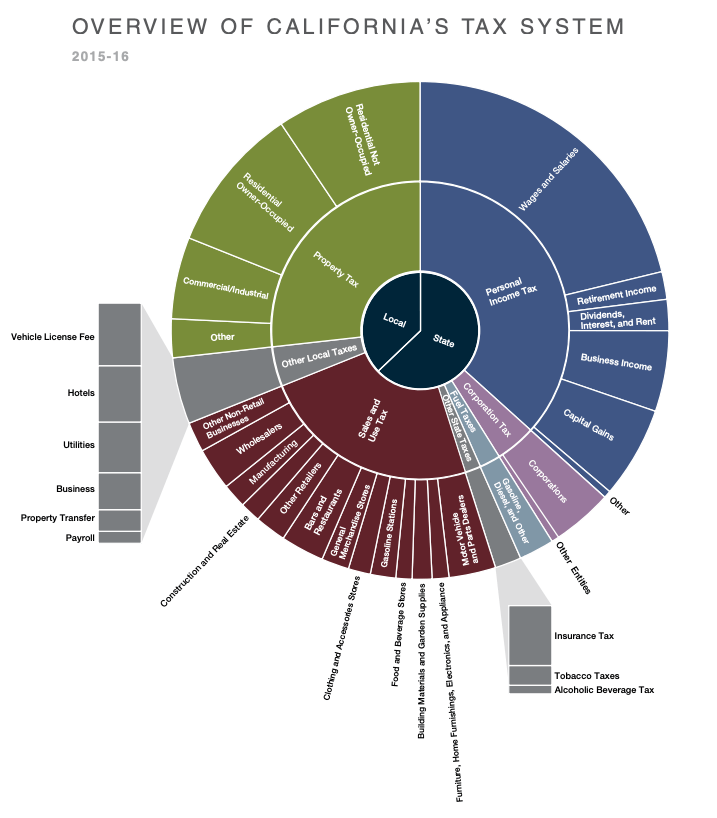

All property tax regulations are defined by Proposition 13 of the. Homeowners property tax exemption Senior tax exemption Veterans property tax exemption and disabled veterans exemption Disability. Here are a few steps you can take to cut your property taxes.

Contact your local tax office. Contact your local tax office. To reduce your property taxes in a few clicks do the following.

The BOE acts in an oversight capacity to ensure compliance by county assessors with property tax laws regulations and assessment issues. By the time you are already paying a certain amount its. Steps to Appeal Your California Property Tax Begin your appeal process by filing an Assessment Appeal Application Form BOE-305-AH which you can obtain from your county.

Up to 25 cash back If you have questions or concerns that your local county assessor cannot answer you might wish to contact the BOEs Property Tax Department. Ask the tax man what steps you need to take in order to appeal your current bill. You may have a huge property but the business is not doing well your tax will be much.

How Do I Reduce My Property Taxes. This video covers how property tax is calculated and how you can pay a lower overall property tax. The table below shows effective property tax rates as well as median annual property tax payments and median home values for each county in California.

How can I lower my property taxes in California. Look for local and state exemptions and if all else fails file a tax appeal to lower your property. Access your DoNotPay account Open our Property Tax feature Provide the necessary answers Follow the instructions from our.

There are a myriad of others. How can I lower my property taxes in California. Property taxes in California are calculated by multiplying the homes assessed value by the current property tax rate.

Assessed value is often. California offers several property tax exemptions that can significantly reduce your annual property tax bill. California doesnt offer many special property tax breaks for seniors although they can claim the standard California write-offs other homeowners are entitled to.

Ask the tax man what steps you need to take in order to appeal your current bill. The available exemptions are. To perform the oversight.

Property Taxes Department Of Tax And Collections County Of Santa Clara

2022 Property Taxes By State Report Propertyshark

Most Texans Pay More In Taxes Than Californians Reform Austin

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Secured Property Taxes Treasurer Tax Collector

U S Cities With The Highest Property Taxes

Will Your California Property Tax Skyrocket In 2020 Wynnecre Orange County Commercial Real Estate Experts

Property Tax Calculator Smartasset

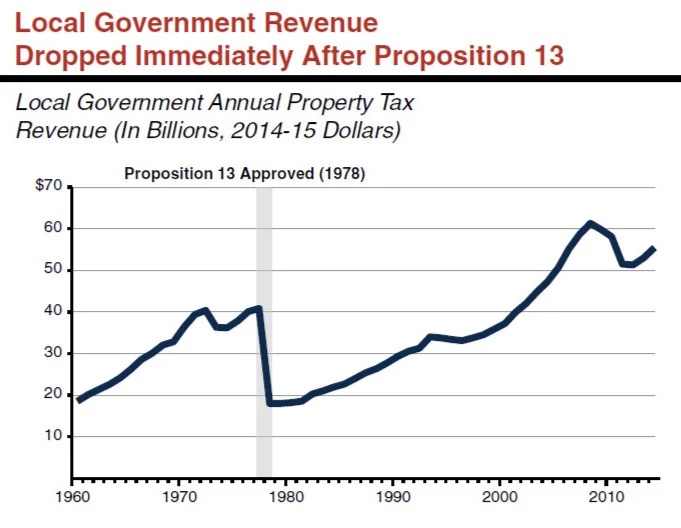

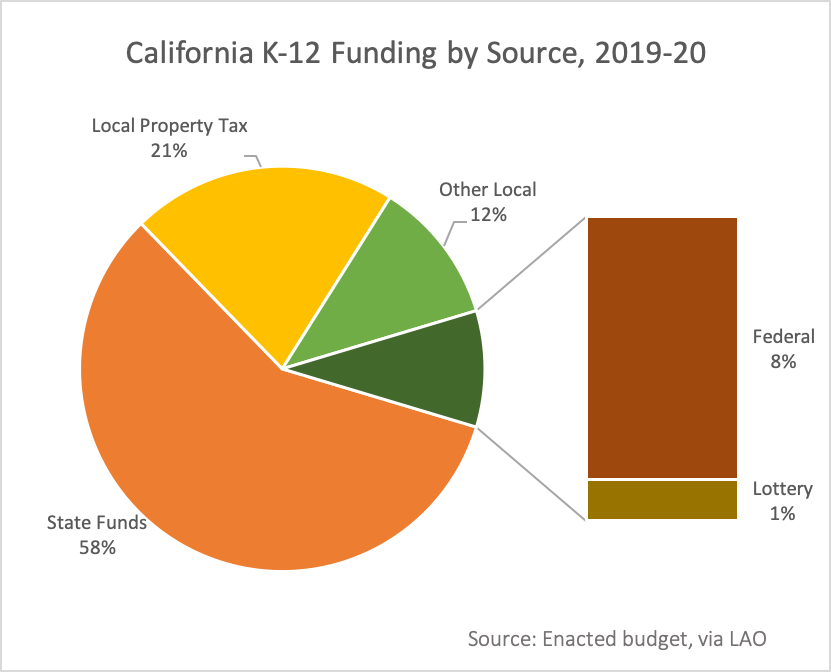

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Property Taxes Department Of Tax And Collections County Of Santa Clara

How To Reduce Your California Property Taxes

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Property Taxes Are Twice As High In Poor Neighborhoods As Rich Ones The Washington Post

Property Tax California H R Block

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

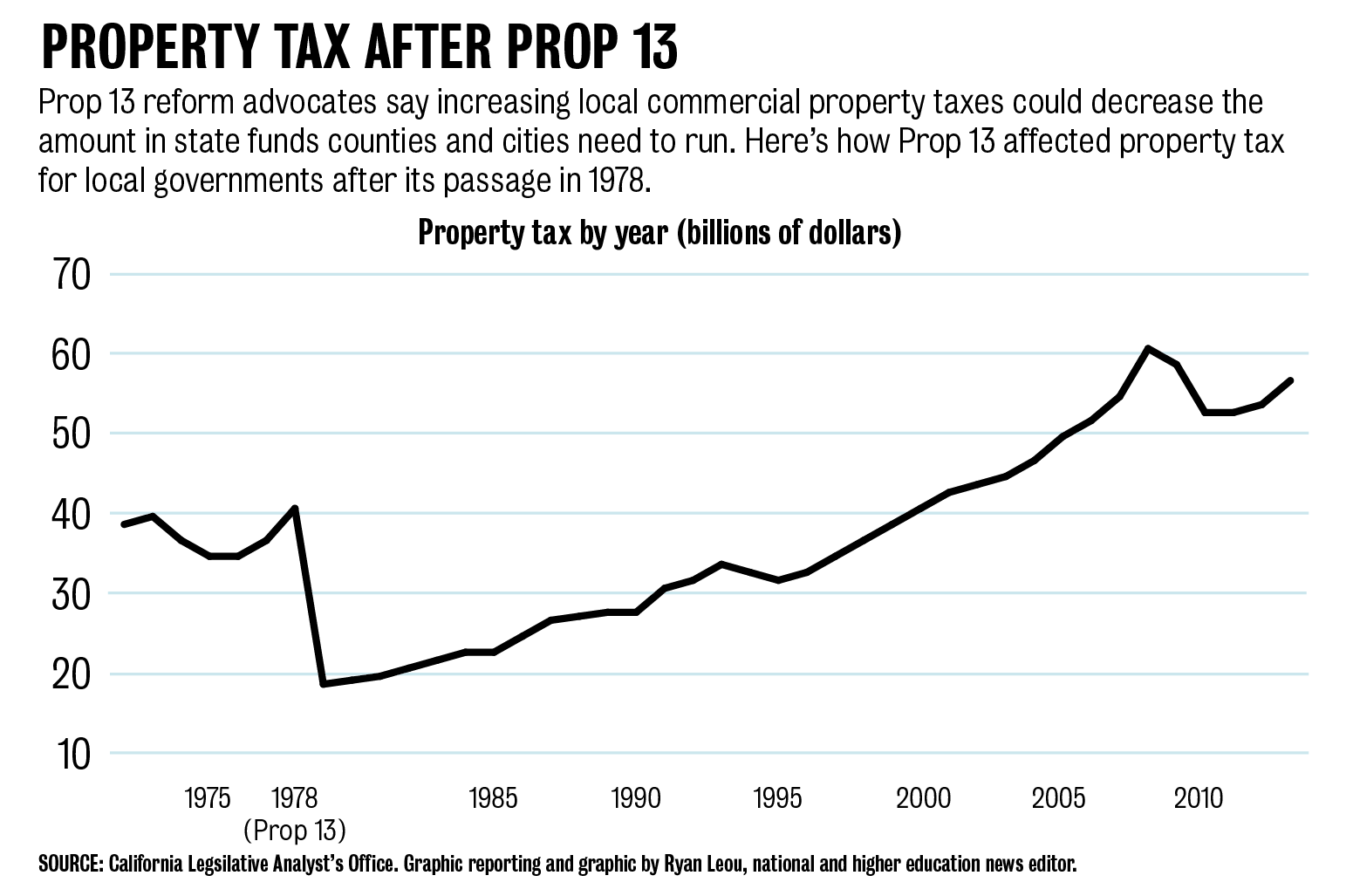

Ucsa Campaign Aims To Reform Prop 13 To Increase Uc Funding Daily Bruin

Why Do Detractors Claim That California Has Excessively High Property Taxes Even Though California S Property Tax Rate Is Among The Lowest In The Nation Quora